Credit Card Validator with CVV – Ensuring Safe Online Transactions

In today’s digital world, online transactions have become the norm. It has never been more convenient to shop online, pay bills, or transfer money from one account to another. However, this convenience comes with a price. The internet is filled with cybercriminals who are always on the lookout for people’s sensitive information, particularly credit card details. As such, it is essential to protect yourself by using a credit card validator with CVV (Card Verification Value). In this article, we will discuss everything you need to know about a credit card validator with CVV and its significance in ensuring safe online transactions.

What is a Credit Card Validator with CVV?

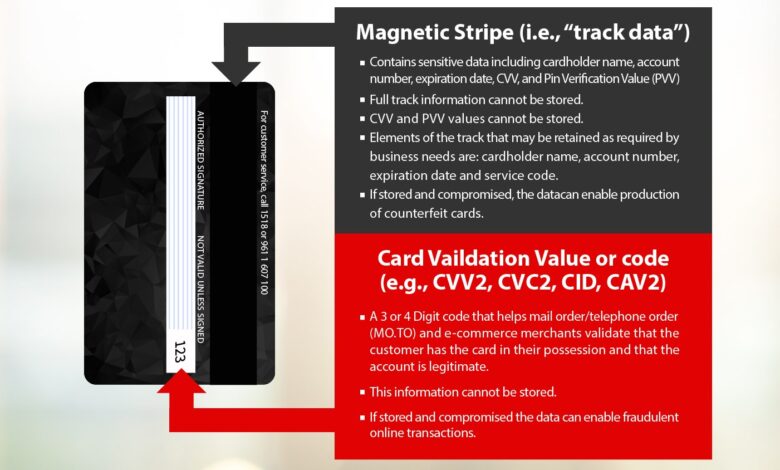

A credit card validator with CVV is a tool that checks the validity of your credit card number and verifies that the CVV code matches the card. The CVV code, also known as Card Verification Code or Card Verification Value, is the three-digit security code printed on the back of your credit card. This tool helps to prevent fraud and ensures that you are not using fake or expired credit card details when making online purchases.

How it Works

A credit card validator with CVV works by performing a series of complicated mathematical algorithms to verify if a given credit card number is valid. It uses an algorithm called the Luhn Algorithm, which calculates the sum of the digits of the credit card number. If the sum is divisible by ten, then the credit card number is considered valid. The tool also performs a check to ensure that the CVV code matches the credit card number.

When to Use a Credit Card Validator with CVV

It is advisable to use a credit card validator with CVV every time you make an online purchase. This tool can help to reduce the risk of fraudulent activities and ensure that you are only using legitimate credit card details. Some online payment gateways may also require you to enter the CVV code before completing a transaction, making it essential to have this information on hand.

Pros and Cons of Using a Credit Card Validator with CVV

Pros

- Protects Against Fraudulent Activities: A credit card validator with CVV can help to prevent fraudulent activities by ensuring that you are using legitimate credit card details.

- Easy to Use: Credit card validators with CVV are easy to use, and anyone can use them without any technical knowledge.

- Saves Time: It saves time, as you do not have to manually check the validity of each credit card number you come across.

Cons

- Cannot Detect Stolen Cards: While a credit card validator with CVV can detect fake or expired credit cards, it cannot detect stolen credit cards. As such, it is still necessary to be cautious when making online transactions and ensure that you are dealing with reputable merchants.

- Not Foolproof: Credit card validators with CVV are not foolproof, and some may still allow fake credit card numbers to pass through their system.

Alternatives to Credit Card Validators with CVV

While credit card validators with CVV are handy tools for verifying the legitimacy of credit card details, there are alternative methods to ensure safe online transactions. These include:

- Two-Factor Authentication: Many payment gateways now offer two-factor authentication, which requires an additional layer of verification, such as a text message, fingerprint, or facial recognition.

- Virtual Credit Cards: Some banks offer virtual credit cards that generate a unique credit card number for every online transaction. This ensures that your actual credit card details are never exposed to merchants.

Step-by-Step Guide on How to Use a Credit Card Validator with CVV

Using a credit card validator with CVV is straightforward. Follow these simple steps to verify your credit card details:

- Go to a trusted credit card validator website.

- Enter your credit card number in the provided field.

- Enter your CVV code in the provided field.

- Click on “Validate” or “Check.”

If your credit card details are valid, you will receive a confirmation message. If not, you may need to check and re-enter your credit card details.

Comparison with Other Credit Card Verification Methods

Credit card validators with CVV are not the only methods used to verify credit card information. Other verification methods include Address Verification Service (AVS) and Cardholder Verification Value (CV2). AVS is a fraud-prevention measure that compares the billing address entered during checkout against the address registered with the credit card issuer. On the other hand, CV2 is similar to CVV but consists of additional security features such as chip-and-pin authentication and tokenization.

Tips for Safe Online Transactions

Here are some tips to help ensure safe online transactions:

- Use reputable merchants and payment gateways.

- Keep your credit card details secure by using strong passwords and two-factor authentication.

- Regularly review your bank statements and report any suspicious activities immediately.

- Use a VPN when making online transactions.

The BestCredit Card Validator with CVV

There are various credit card validators with CVV available online, and choosing the right one can be overwhelming. Here are some of the best credit card validators with CVV:

- Stripe: Stripe is a payment gateway that offers a credit card validator with CVV. It is easy to use and provides accurate results.

- PayPal: PayPal’s credit card validator with CVV is an excellent tool for verifying credit card details. It also offers additional security features such as two-factor authentication.

- Braintree: Braintree is another payment gateway that offers a credit card validator with CVV. It is known for its accuracy and security features.

Conclusion

In conclusion, using a credit card validator with CVV is essential for ensuring safe online transactions. It helps to prevent fraudulent activities and ensures that you are only using legitimate credit card details. While it may not be foolproof, it is still an effective tool that can save you time and money in the long run. Additionally, there are other alternative methods to verify credit card details, such as two-factor authentication and virtual credit cards. By following the tips mentioned earlier and using reputable payment gateways, you can safeguard yourself against cybercriminals and enjoy worry-free online transactions.

FAQs

- Can a credit card validator with CVV detect stolen credit cards?

A credit card validator with CVV cannot detect stolen credit cards. It can only verify if the credit card number and CVV code match and are valid.

- Is it safe to enter my credit card details into a credit card validator with CVV?

Yes, it is safe to enter your credit card details into a credit card validator with CVV. However, ensure that you are using a reputable website or payment gateway.

- Are credit card validators with CVV 100% accurate?

While credit card validators with CVV are generally accurate, they are not 100% foolproof and may still allow fake credit card numbers to pass through their system.

- Can I use a credit card validator with CVV for international transactions?

Yes, you can use a credit card validator with CVV for international transactions. However, ensure that the website or payment gateway supports international transactions.

- What should I do if I suspect fraudulent activity on my credit card?

If you suspect fraudulent activity on your credit card, contact your bank immediately and report the incident. The sooner you report it, the better chance you have of recovering any lost funds.