Understanding Credit Card Codes

Are you confused about credit card codes? Do you want to know what they are and how they work? If so, you’re not alone. Many people don’t understand credit card codes and what they mean.

In this ultimate guide, we’ll cover everything you need to know about credit card codes. We’ll explain what they are, how they work, and why they’re important. We’ll also discuss the pros and cons of using credit card codes, alternatives to using them, and provide step-by-step instructions on how to use them. By the end of this guide, you’ll be an expert on credit card codes.

What Are Credit Card Codes?

Credit card codes are a series of numbers and/or letters that are used to identify a specific credit card account. They are also known as verification codes, security codes, or CVV (Card Verification Value) codes. Credit card codes are typically three or four digits long and are located on the back of a credit card.

Credit card codes serve as an additional security measure to ensure that a credit card is being used by its rightful owner. When making a purchase online or over the phone, the merchant will ask for the credit card code to verify that the person making the purchase has the actual credit card in their possession.

How Do Credit Card Codes Work?

When a credit card is issued, a unique credit card code is generated and assigned to that account. This code is then stored securely by the credit card issuer and is used to verify the identity of the cardholder when a purchase is made.

When making a purchase, the credit card code is entered into the payment form along with the credit card number, expiration date, and billing address. The merchant’s payment processor then sends this information to the credit card issuer for verification. If the credit card code is correct, the transaction is approved, and the purchase is completed.

When Should You Use Credit Card Codes?

Credit card codes should be used whenever you make a purchase online or over the phone. They provide an additional layer of security to ensure that your credit card is being used by its rightful owner.

You should never share your credit card code with anyone, and you should always check to make sure that the website or merchant you’re making a purchase from is legitimate before entering your credit card information.

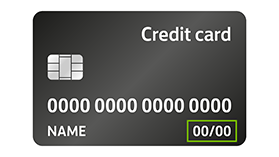

How To Find Your Credit Card Code

Your credit card code can be found on the back of your credit card. It’s typically located in the signature panel and is either three or four digits long. Some credit card issuers may also refer to it as a CVV or CSC code.

It’s important to keep your credit card code secure and never share it with anyone. If someone gains access to your credit card code, they could use your credit card fraudulently.

The Pros and Cons of Using Credit Card Codes

Pros

- Additional security: Credit card codes provide an additional layer of security to ensure that your credit card is being used by its rightful owner.

- Easy to use: Credit card codes are easy to use and only require a few extra seconds to enter when making a purchase.

- Fraud prevention: Credit card codes help prevent credit card fraud by making it more difficult for unauthorized users to make purchases.

Cons

- Limited protection: Credit card codes are not foolproof and can still be compromised by determined hackers or scammers.

- Inconvenient: Having to enter a credit card code every time you make a purchase can be inconvenient, especially if you’re making multiple purchases in a short period of time.

- Not always required: Some merchants don’t require a credit card code, which means that the additional security measure is not being utilized.

Alternatives to Using Credit Card Codes

If you don’t want to use credit card codes, there are alternative payment methods that you can use. These include:

- PayPal: PayPal is a popular online payment service that allows you to make purchases without entering your credit card information.

- Apple Pay: Apple Pay is a mobile payment and digital wallet service that allows you to make purchases using your iPhone or other Apple devices.

- Google Pay: Google Pay is a similar service to Apple Pay, but it works on Android devices.

Step-by-Step Instructions for Using Credit Card Codes

To use a credit card code, follow these step-by-step instructions:

- Locate the credit card code on the back of your credit card.

- When making a purchase online or over the phone, enter the credit card code along with the other required information.

- Verify that the website or merchant you’re making a purchase from is legitimate before entering your credit card information.

- Submit your payment information and wait for the transaction to be approved.

How Credit Card Codes Compare to Other Security Measures

Credit card codes are just one of many security measures that are used to protect credit card users from fraud. Other security measures include:

- Chip-enabled credit cards: Chip-enabled credit cards have a microchip embedded in them that generates a unique code for each transaction. This makes it more difficult for fraudsters to make counterfeit copies of the credit card.

- Two-factor authentication: Some credit card issuers require two-factor authentication, which means that in addition to entering your credit card information, you also need to enter a code sent to your phone or email.

- Fraud detection software: Many credit card issuers use fraud detection software to monitor credit card activity and flag any suspicious transactions.

Each security measure has its own strengths and weaknesses, and credit card issuers may use a combination of measures to protect their customers.

Tips for Using Credit Card Codes

Here are some tips to help you use credit card codes effectively:

- Keep your credit card code secure: Never share your credit card code with anyone and don’t write it down where others can find it.

- Check for legitimacy: Before entering your credit card information, make sure that the website or merchant you’re making a purchase from is legitimate.

- Use multiple security measures: Consider using multiple security measures, such as two-factor authentication or chip-enabled credit cards, to better protect your credit card.

- Monitor your credit card activity: Regularly check your credit card statements for any unauthorized transactions and report them immediately if you notice anything suspicious.

The Best Credit Card Codes

There’s no one “best” credit card code, as they all serve the same purpose of providing an additional layer of security for credit card users. However, here are some credit card codes that are commonly used by different credit card issuers:

- Visa: CVV code (three digits)

- Mastercard: CVC code (three digits)

- American Express: CID code (four digits)

Conclusion

Credit card codes are an important security measure that help protect credit card users from fraud. They are easy to use and provide an additional layer of security when making purchases online or over the phone. While they are not foolproof, credit card codes can help prevent unauthorized transactions and make it more difficult for fraudsters to steal your credit card information.

Remember to keep your credit card code secure and check for legitimacy before entering your credit card information. Consider using multiple security measures, such as two-factor authentication or chip-enabled credit cards, to better protect your credit card. By following these tips, you can use credit card codes effectively and with confidence.

FAQs

- What should I do if I suspect my credit card code has been compromised? If you suspect that your credit card code has been compromised, contact your credit card issuer immediately to report the issue and request a new credit card.

- Do all credit cards have a credit card code? No, not all credit cards have a credit card code. Some credit card issuers may not require one, while others may have different types of codes.

- Are credit card codes the only security measure for credit cards? No, credit card codes are just one of many security measures used by credit card issuers. Other measures include chip-enabled credit cards, two-factor authentication, and fraud detection software.

- Is it safe to enter my credit card code on a website or over the phone? As long as you’re using a legitimate website or merchant, it’s generally safe to enter your credit card code. However, it’s always important to be cautious and check for legitimacy before entering any sensitive information.

- Can someone steal my credit card information if they have my credit card code? While having your credit card code makes it easier for fraudsters to make unauthorized transactions, they would still need additional information, such as your credit card number and expiration date, to fully access your account.6. Can credit card codes be reused for multiple transactions? No, credit card codes are unique to each transaction and cannot be reused for future purchases.

- What should I do if I lose my credit card code? If you lose your credit card code, contact your credit card issuer for a new code or to request a new credit card with a new code.

- How can I protect myself from credit card fraud? In addition to using credit card codes and other security measures provided by your credit card issuer, you can also monitor your credit card activity regularly, check your credit report for any suspicious activity, and be cautious when providing your credit card information online or over the phone.

- What should I do if I notice unauthorized transactions on my credit card statement? If you notice any unauthorized transactions on your credit card statement, contact your credit card issuer immediately to report the issue and dispute the charges.

- Are there any downsides to using credit card codes? While credit card codes provide an additional layer of security for credit card users, they may not be foolproof and can still be vulnerable to certain types of fraud. Additionally, some merchants may not require credit card codes, which could make it easier for fraudsters to make unauthorized transactions.11. Can I use the same credit card code for multiple transactions on the same website? No, credit card codes are unique to each transaction and cannot be reused for future purchases.

- How can I tell if a website is legitimate before entering my credit card information? Look for security indicators such as a padlock icon in the address bar or a URL that begins with “https” instead of “http.” You can also search for reviews or ratings of the website from other users to help determine its legitimacy.

- Are there any fees associated with using credit card codes? No, there are no additional fees associated with using credit card codes, as they are included as part of standard credit card security measures.

- What should I do if I forget my credit card code? If you forget your credit card code, contact your credit card issuer for assistance in resetting or retrieving your code.

- Can credit card codes be guessed or hacked? While it’s theoretically possible for credit card codes to be guessed or hacked, they are designed to be difficult to predict or replicate, making it unlikely for fraudsters to successfully steal credit card information using just the code. However, it’s still important to be vigilant and take additional security measures to protect your credit card information.