How to Protect Yourself from Credit Card Theft

Credit card theft is a growing concern in today’s digital age. With the increasing number of online transactions, it has become easier for fraudsters to steal credit card information and use it for their own gain. In this article, we will discuss who is at risk, what credit card theft is, when it can happen, how to protect yourself, the pros and cons of different protection methods, alternative solutions, step-by-step guides on what to do if you are a victim of credit card theft, comparisons of different protection services, tips to prevent theft, and the best ways to safeguard your financial information.

Who Is at Risk?

Simply put, anyone who owns a credit card is at risk of credit card theft. However, some groups are more vulnerable than others. For example, people who make online purchases frequently, travel frequently, or use public Wi-Fi networks are at greater risk. Similarly, those who store their credit card information on their phones or computers also face a higher risk of theft.

What Is Credit Card Theft?

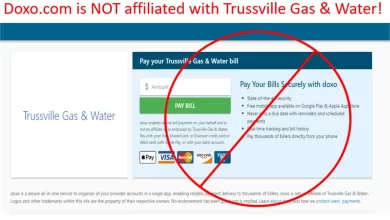

Credit card theft is the act of stealing someone’s credit card information without their consent. This can be done by various means, such as hacking into a retailer’s database, using skimming devices at ATMs or gas pumps, or simply stealing the physical card itself. Once the thief has access to the credit card details, they can use it to make unauthorized purchases or even sell the information on the dark web.

When Can It Happen?

Credit card theft can happen any time, anywhere. However, some situations present a greater risk than others. For example, large-scale data breaches, such as the one experienced by Target in 2013, can result in the theft of millions of credit card records. Similarly, using public Wi-Fi networks or making online purchases on unsecured websites can also put you at risk.

How to Protect Yourself?

Protecting yourself from credit card theft requires a combination of proactive measures and reactive strategies. Here are some ways in which you can safeguard your financial information:

Use Strong Passwords

Use strong, unique passwords for all your accounts. Avoid using the same password for multiple accounts, as this makes it easier for hackers to gain access to all your information.

Monitor Your Accounts Regularly

Check your credit card statements regularly to ensure there are no unauthorized transactions. If you notice anything suspicious, report it to your bank immediately.

Be Careful with Your Personal Information

Be cautious when sharing your personal information online or over the phone. Never give out your credit card details unless you are sure of the legitimacy of the transaction.

Use a Virtual Credit Card

Consider using a virtual credit card for online purchases. A virtual credit card is a temporary number that is linked to your actual credit card but expires after a single use. This reduces the risk of your credit card information being stolen and used fraudulently.

Pros and Cons of Different Protection Methods

There are several protection methods available to safeguard your financial information. Here are some of the pros and cons of different protection methods:

Credit Monitoring Services

Credit monitoring services alert you when there is any activity on your credit report. While this can provide early detection of any fraudulent activity, it does not prevent credit card theft from happening in the first place.

Identity Theft Insurance

Identity theft insurance covers the costs associated with recovering your identity if it is stolen. However, it does not prevent identity theft from occurring.

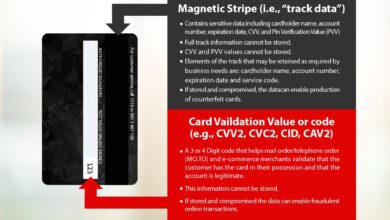

EMV Chip Cards

EMV chip cards provide greater security than traditional magnetic stripe cards, as they generate a unique code each time the card is used. However, they are not foolproof, and fraudsters have found ways to bypass the security features.

Alternative Solutions

Apart from the traditional methods of protecting your financial information, there are other solutions that you can use:

Two-Factor Authentication

Two-factor authentication adds an extra layer of security to your online accounts. This requires a password and a unique code sent to your phone or email to access your account.

Virtual Private Network (VPN)

A virtual private network (VPN) encrypts your internet connection, making it more difficult for hackers to intercept your personal information.

Step-by-Step Guide on What to Do If You Are a Victim of Credit Card Theft

If you suspect that your credit card has been stolen, here’s what you should do:

- Contact your bank or credit card company immediately.

- Review your recent transactions to identify any unauthorized charges.

- Place a fraud alert on your credit report.

- File a police report.

- Report the theft to the Federal Trade Commission (FTC).

Comparison of Different Protection Services

Here’s a comparison of different protection services available:

| Service | Pros | Cons |

|---|---|---|

| Credit Monitoring Services | Early detection of fraudulent activity | Does not prevent identity theft |

| Identity Theft Insurance | Covers the costs of recovering identity | Does notprevent identity theft |

| EMV Chip Cards | Greater security than magnetic stripe cards | Not foolproof |

| Two-Factor Authentication | Adds an extra layer of security to online accounts | Can be inconvenient |

| Virtual Private Network (VPN) | Encrypts internet connection | Slows down internet speed |

Tips to Prevent Credit Card Theft

Here are some tips to prevent credit card theft:

- Keep your credit cards in a safe place.

- Do not share your personal information unless it is necessary.

- Use strong, unique passwords for all your accounts.

- Check your credit report regularly.

- Be cautious when using public Wi-Fi networks.

The Best Ways to Safeguard Your Financial Information

The best ways to safeguard your financial information include:

- Using a virtual credit card for online purchases.

- Using two-factor authentication for online accounts.

- Using a VPN to encrypt your internet connection.

- Monitoring your credit report regularly for any fraudulent activity.

- Being vigilant when sharing your personal information online or over the phone.

Conclusion

Credit card theft is a serious problem that can have severe consequences for victims. However, by taking proactive measures and using protection services, you can reduce the risk of theft and safeguard your financial information. Remember to monitor your accounts regularly, use strong passwords, and be cautious when sharing personal information online or over the phone. By following these simple steps, you can protect yourself from credit card theft and enjoy peace of mind.

FAQs

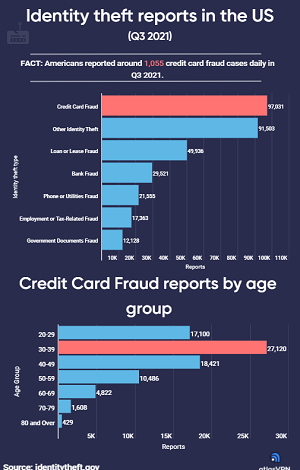

Q1. How common is credit card theft?

A1. Credit card theft is becoming increasingly common in today’s digital age. According to the Federal Trade Commission, there were over 270,000 reported cases of credit card theft in 2020 alone.

Q2. Can I be held responsible for unauthorized charges on my credit card?

A2. Generally, you are not held responsible for unauthorized charges on your credit card. However, it is important to report any suspicious activity to your bank or credit card company as soon as possible.

Q3. Are EMV chip cards safer than magnetic stripe cards?

A3. Yes, EMV chip cards are considered safer than magnetic stripe cards. This is because they generate a unique code each time the card is used, making it more difficult for fraudsters to replicate the card.

Q4. How can I tell if my credit card information has been stolen?

A4. You may notice unusual activity on your credit card statement, such as purchases you did not make or charges from unfamiliar merchants. If you suspect that your credit card information has been stolen, contact your bank or credit card company immediately.

Q5. What should I do if I lose my credit card?

A5. If you lose your credit card, contact your bank or credit card company immediately to report the loss. They will cancel the card and issue you a new one.## Alternatives to Credit Cards

While credit cards are a convenient way to make purchases and build credit, they are not the only option available. Here are some alternatives to consider:

- Debit cards: Like credit cards, debit cards can be used for purchases, but instead of borrowing money, the funds come directly from your bank account.

- Prepaid cards: These cards are loaded with a set amount of money and can be used like a credit or debit card. Once the funds are depleted, the card must be reloaded.

- Cash: While cash may seem old-fashioned, it is still widely accepted and can help you stick to a budget.

Step-by-Step Guide to Reporting Credit Card Theft

If you suspect that your credit card information has been stolen, follow these steps to report the theft and protect your financial information:

- Contact your bank or credit card company immediately to report the theft.

- Review your credit report and check for any suspicious activity.

- Place a fraud alert on your credit report to prevent fraudulent accounts from being opened in your name.

- File a police report and provide any evidence of the theft, such as unauthorized charges on your statement.

- Monitor your accounts closely and report any further suspicious activity.

Pros and Cons of Two-Factor Authentication

Two-factor authentication (2FA) adds an extra layer of security to online accounts by requiring users to provide two forms of identification, such as a password and a fingerprint or a code sent to their mobile device. While 2FA can enhance security, there are also some drawbacks to consider.

Pros:

- Provides an extra layer of security

- Helps prevent unauthorized access to your accounts

Cons:

- Can be inconvenient, especially if you don’t have your phone with you

- May not be foolproof, as hackers can still find ways to bypass the system

Comparing VPN Providers

If you decide to use a VPN to protect your internet connection, it’s important to choose a reputable provider. Here are some factors to consider when comparing VPN services:

- Privacy policy: Look for a provider with a strict no-logging policy to ensure your data is not being tracked or sold.

- Server locations: Choose a provider with servers in the countries you plan to access to ensure fast and reliable connections.

- Connection speed: Some providers may slow down your internet speed, so look for one with fast server speeds.

- Price: VPN services can vary widely in price, so compare plans and features to find one that fits your budget.

Conclusion

Credit card theft is a serious problem that can have long-lasting consequences for victims. However, by taking proactive measures and using protection services, you can reduce the risk of theft and safeguard your financial information. Remember to monitor your accounts regularly, use strong passwords, and be cautious when sharing personal information online or over the phone. By following these tips and alternatives, you can protect yourself from credit card theft and enjoy peace of mind.