Real Card Numbers Are They Safe to Use in 2023?

As the world becomes increasingly digital, more and more people are turning to online shopping. With this comes the need for secure payment methods. While many consumers choose to use credit cards, there is always a concern about the security of personal information, including real card numbers. In this article, we will explore the safety of using real card numbers, how to protect yourself against fraud, and what to do if you fall victim to credit card theft.

What Are Real Card Numbers?

Real card numbers are simply the numbers associated with your credit or debit card. These numbers are used by merchants to process payments when you make a purchase. In addition to the number, your card also has an expiration date and a CVV (card verification value) code. When making purchases online, you may also be asked for your billing address.

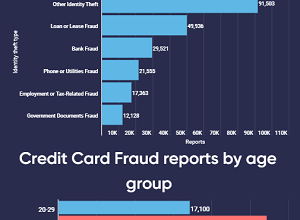

How Do Real Card Numbers Get Stolen?

Credit card fraud can happen in a variety of ways. Skimming devices placed on ATMs, gas pumps, or other payment terminals can capture card data when you swipe your card. Online scams such as phishing emails or fake websites can trick you into giving up your card information. Hackers can also gain access to databases containing card details.

Is It Safe to Use Real Card Numbers Online?

The short answer is yes, it is generally safe to use your real card number online. However, you should take precautions to protect yourself from fraud. One way to do this is to only shop on secure websites that have HTTPS encryption. You can also use virtual credit card numbers provided by your bank or credit card issuer. These are temporary card numbers that expire after one use, so even if a thief gets their hands on the number, they won’t be able to use it again.

How Can I Protect Myself Against Credit Card Fraud?

There are several steps you can take to protect yourself from credit card fraud:

- Monitor your accounts regularly, and report any suspicious activity to your bank or credit card issuer immediately.

- Use a strong, unique password for each online account and change it regularly.

- Be wary of unsolicited emails or phone calls asking for personal information.

- Keep your computer and mobile devices up-to-date with the latest security patches.

- Use two-factor authentication whenever possible.

What Should I Do If My Real Card Number Is Stolen?

If you suspect that your real card number has been stolen, you should contact your bank or credit card issuer right away. They will be able to cancel the card and issue a new one. You should also review your account statements carefully to look for any unauthorized charges.

Conclusion

While credit card fraud is a concern, using real card numbers online can still be safe if you take the necessary precautions. Shopping on secure websites and using virtual credit card numbers are just a few ways to protect yourself against fraud. By monitoring your accounts regularly and being vigilant about keeping your personal information secure, you can help prevent credit card theft and minimize any damage if your card number is ever stolen.

FAQs

- Can I use a virtual credit card number more than once?

- No, virtual credit card numbers are temporary and expire after one use.

- What should I do if I suspect credit card fraud?

- Contact your bank or credit card issuer immediately to report any suspicious activity.

- How can I tell if a website is secure?

- Look for “HTTPS” in the website address, and look for a padlock icon in your browser’s address bar.

- Can hackers steal my card information from databases?

- Yes, hackers can gain access to databases containing card details and use that information for fraudulent purposes.

- How often should I change my passwords?

- It is recommended to change your passwords at least every six months, and use a strong, unique password for each account.